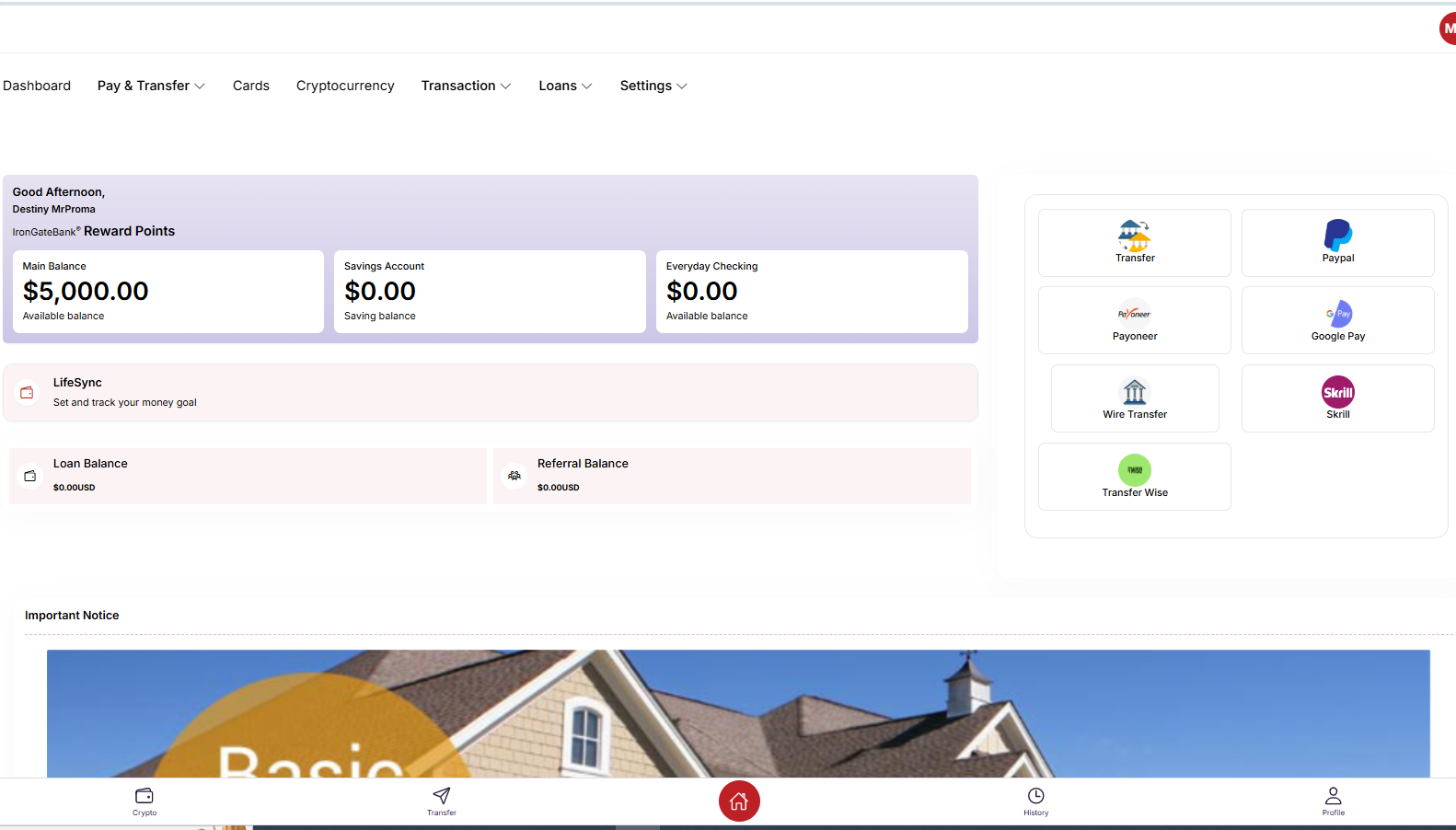

IronGateBank Full Institutional Overview

IronGateBank is a forward-thinking financial institution designed to combine the stability of traditional banking with the efficiency and intelligence of modern financial technology. Built on a foundation of security, transparency, and customer-centric service, the bank positions itself as a safe and strategic partner for individuals, businesses, and corporate clients seeking reliable financial solutions.

1. Overview of IronGateBank

IronGateBank operates as a secure financial institution committed to providing high-quality banking services across digital and physical channels. The name reflects its core identity:

-

“Iron” represents durability, strength, and resilience.

-

“Gate” symbolizes controlled access, protection, and structured financial pathways.

Together, IronGateBank embodies a banking institution where clients’ funds, data, and financial aspirations are protected and supported.

2. Banking Philosophy

IronGateBank’s philosophy is built on three major pillars:

A. Security First

The bank prioritizes the safety of customer funds through advanced cybersecurity systems, strict compliance protocols, and continuous risk management.

B. Innovation Always

IronGateBank embraces digital transformation. From mobile-first banking to AI-assisted customer support, its services are designed for modern customers who value speed and convenience.

C. People Focused

Every product and service is designed to support the real financial needs of individuals and businesses offering clarity, transparency, and personalized financial guidance.

3. Core Banking Services

IronGateBank provides a full suite of banking services, including:

A. Personal Banking

-

Checking and savings accounts

-

Debit cards and virtual cards

-

Mobile banking

-

Personal loans and credit facilities

-

Budgeting tools and financial insights

B. Business Banking

-

Business accounts for SMEs and corporations

-

Merchant payment solutions

-

Invoicing and payroll management

-

Business loans and lines of credit

-

Corporate financial advisory

C. Investment & Wealth Services

D. Digital Banking Features

-

Online onboarding (KYC & identity verification)

-

Instant transfers and payments

-

Fraud monitoring

-

Multi-layer authentication

-

Real-time account notifications

4. Technology & Security Infrastructure

IronGateBank uses modern financial technologies to maintain smooth and secure banking operations:

-

End-to-end encryption

-

AI-powered fraud detection

-

24/7 transaction monitoring

-

Secure cloud-based systems

-

Biometric and multi-factor authentication

-

Compliance with international financial regulations

These measures ensure that every transaction is tracked, every customer protected, and every service reliable.

5. Customer Commitment

IronGateBank is built on a strict commitment to:

Transparency

Customers always understand fees, processes, and policies.

Accessibility

Banking services are available anywhere, anytime, with simple interfaces and responsive support.

Growth

Whether supporting a student with their first account or a corporation with major financing goals, IronGateBank helps customers grow financially.

Trust

Everything from technology to staff conduct is designed to earn and maintain customer trust.

6. Future Outlook

IronGateBank aims to become a global reference point for digital-first banking excellence. Its long-term objectives include:

-

Expanding into new territories

-

Advancing digital financial products

-

Strengthening AI-based financial intelligence

-

Supporting financial inclusion for underserved communities

-

Becoming a leader in secure digital banking

Conclusion

IronGateBank is not just a name it is a complete banking institution built on resilience, trust, and innovation. It offers secure financial services backed by modern technology while maintaining the values that define strong, dependable banks. Through its commitment to safety, transparency, and customer empowerment, IronGateBank positions itself as a financial partner capable of supporting long-term stability, smart financial decisions, and continuous growth.